Links for Thought -- April 6, 2012

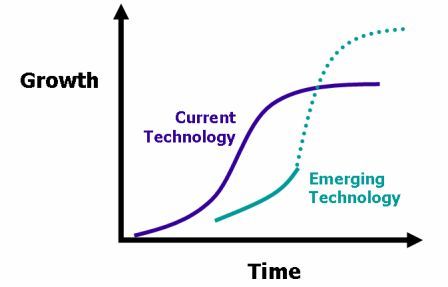

/Disruptive Innovation: Can Health Care Learn from Other Industries? (HealthAffairs.org) -- This is a great conversation with Clayton Christensen on the impact that disruptive innovation can have on the health care industry. Christensen gave us THE essential mental model for understanding innovation, and it's important to understand how this model will impact health care over the coming years. One of my biggest critiques over the health care cost concern is that the entire conversation assumes the past growth rate will continue forward in perpetuity. Meanwhile, right now there are rapid deflationary innovations sweeping through the industry that I think will not just mitigate, but realistically will drive down the cost of medical treatment over time. In order to understand this, one needs to know the distinction between something that is merely an innovation, and something that is a DISRUPTIVE innovation.

Important Read on Franchise Investing and Investing "Gurus" (CS Investing) -- Important read is definitely the best way to describe this post. Here CS Investing gives us a look at what a competitive moat is and what the concept means. Plus we get a great glimpse into how some of the most prominent investment gurus, including Warren Buffett, analyze moats when making their own investments.

Keynes: One Mean Money Manager (Wall Street Journal) -- Jason Zweig takes a look at the investment track record John Maynard Keynes and wow was it fantastic. Despite Keynes being a macroeconomist, his successes in investment were primarily driven on the micro level, combined with an understanding of the behavioral element to investing. This closely aligns with the value investing school of thought on markets, that alpha is possible with scrupulous fundamental analysis.

Climate Change Isn't Liberal or Conservative: It's Reality (Boing Boing) -- In all seriousness, the title of this article should go without saying. I first learned that climate change was real when the family swimming pool, which had frozen every summer as a child for me to play hockey on, just stopped freezing enough to skate on. This started happening in the late 1990s, but now things have been taken to a whole new level. I am increasingly frustrated and sickened by the "questions" raised over this very real issue.

Cutting A Star Out of the Picture (Wall Street Journal) -- Speaking of my childhood days playing hockey, this article is about the Islanders severing ties to Pat LaFontaine. I grew up a rabid Isles fan, and even bigger Pat LaFontaine fan. Pat is one of the all-time great Islanders and a model citizen. Charles Wang once again demonstrates why he is a despicable person. While we're on the topic of Pat LaFontaine, go check out his Companions in Courage website to learn about (and perhaps contribute to) some of his charitable initiatives.

Commodities Supercycle or Bursting Bubble? (Pragmatic Capitalism) -- This has been my question of the week, and led to today's post on our country's subsidy for commodity speculation. It's an important question, because the answer has serious implications for the global economy. Give this a read to help prepare for a conversation on this blog in the coming months as to whether the commodities bull is a monetary policy phenomenon or an emerging market growth story (or a little bit of both).

I typically conclude this weekly links post with a nature picture, but for a second week in a row I will depart with a twist. Here is Van Morrison with The Band performing Caravan at The Last Waltz, rock out for the long weekend, and happy holidays to all: